Do you really love your Las Vegas home, yet are finding it harder and harder to make your mortgage payments? A home loan modification may help you keep your home by lowering your mortgage payment.

Getting your mortgage payment lowered could mean the difference between staying in your home and having to move. If you can’t make your mortgage payments and don’t get a loan modification, you’ll either have to short sale your home or the lender will foreclose. If that happens, you’ll probably have to rent for at least a few years (both a short sale and a foreclosure will negatively impact your credit score).

So if your money is getting tight and fear that you may not be able to pay your mortgage (or if you’ve already missed mortgage payments), then you should at least consider a loan modification. Loan modifications are changes made to the terms of your mortgage such that your monthly payments are lower.

Here are three home loan modification options:

Option #1: MHAP (Making Home Affordable Program). This is a federal program designed to help American homeowners keep their homes, by making changes to qualifying mortgages (the MHAP programs come with restrictions and you must qualify in order to participate). Under MHAP, there are five programs that you may qualify for:

- HAMP (Home Affordable Modification Program) can lower your payments so that they are no more than 31% percent of your pre-tax income.

- HARP (Home Affordable Refinance Program) can lower your interest rate (although refinancing fees do apply).

- 2MP (Second Lien Modification Program) can lower the principal balance on your second mortgage (if you modify your first mortgage through HAMP).

- HAFA (Home Affordable Foreclosure Alternatives Program) allows you to get out of your mortgage without fear of a deficiency judgment (which is when the lender comes after you for the difference between your mortgage balance and what the market value of your home). Participating lenders only have to consider you for HAFA but are not compelled to approve your short sale under this program. A successful short sale can still be negotiated outside of HAFA.

- HHF (Housing Finance Agency Innovation Fund for the Hardest Hit Housing Markets) can help you avoid foreclosure (especially if you’re under or unemployed).

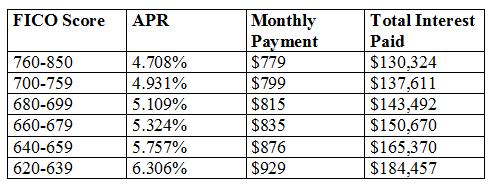

Option #2: Interest rate reduction. Even a relatively small change in your interest rate can lower your monthly payments dramatically, often by several hundred dollars a month (depending on your loan balance and interest rate of course). That can really add up over a year, and certainly over the life of your Las Vegas home mortgage.

Option #3: Loan balance reduction. Unfortunately, loan balance reductions (also called loan forgiveness) – when the lender actually reduces the amount you owe on your mortgage – are rare. If you can negotiate a loan balance reduction, though, it can have the same effect on your monthly mortgage payments as an interest rate reduction (reduce them) and also help you get back to positive equity.

If you’re having trouble affording your monthly mortgage payments, and a loan modification doesn’t work, another option is a Las Vegas short sale. At Shelter Realty you can get cost-free advice regarding possible foreclosure alternatives. If you decide to do a short sale, we have the expert help you’ll need. Call us right now at (702)376-7379 or visit www.shelterrealty.com.

Paul Rowe is a real estate investor and REALTOR® with Shelter Realty Inc. He can be reached at (702) 376-7379. With hundreds of short sales negotiated successfully over the past 12 years, Paul works exclusively with distressed property owners and potential foreclosure and short sale victims in Southern Nevada who owe more on their mortgage than their property will appraise for.