It’s obviously easier to picture the process of estimating value on an existing property in a neighborhood that has a history of home sales, but the task of determining the value on new construction projects does pose some challenges.

Appraisals on homes that haven’t been built yet generally require the contractor and home buyer to supply more documentation in order to get a more accurate estimate of the property’s value.

The main purpose of this article is to give an overview of the appraisal process for a home buyer that is building a home vs purchasing standing inventory.

For some, building a new home can be an exciting and overwhelming. Watching a project transform from idea to completed home with a front yard, white picket fence and a custom red front door is a rewarding experience.

Even if you are paying attention to all of information from the beginning, there are still several details that have a tendency to catch even experienced builders off guard.

Game time decisions have to be made as cabinets and corners line up differently than the initial drawing could show, flooring doesn’t match the wall colors, or the sun hits a window the wrong way at dinner time.

While the last minute updates may cost you more money, they might also have an impact on the value of the property.

What Does An Appraiser Need For New Construction?

Plans –

The plans or construction drawings are usually done by your builder or architect. It lays out the floor plan of your home, sizes of rooms and square footage of your home.

They should include a floor plan layout, front elevation, real elevation & side elevations, mechanical and electrical details.

Specifications / Descriptions Of Material –

A “Spec” sheet has the type of construction materials you will be using. For example, whether your home will be built with standard 2 x 4’s or 2 x 6’s.

It also contains the type of insulation, roofing and exterior products that will be used in the construction, as well as floors, counter tops and appliances for the inside dressing.

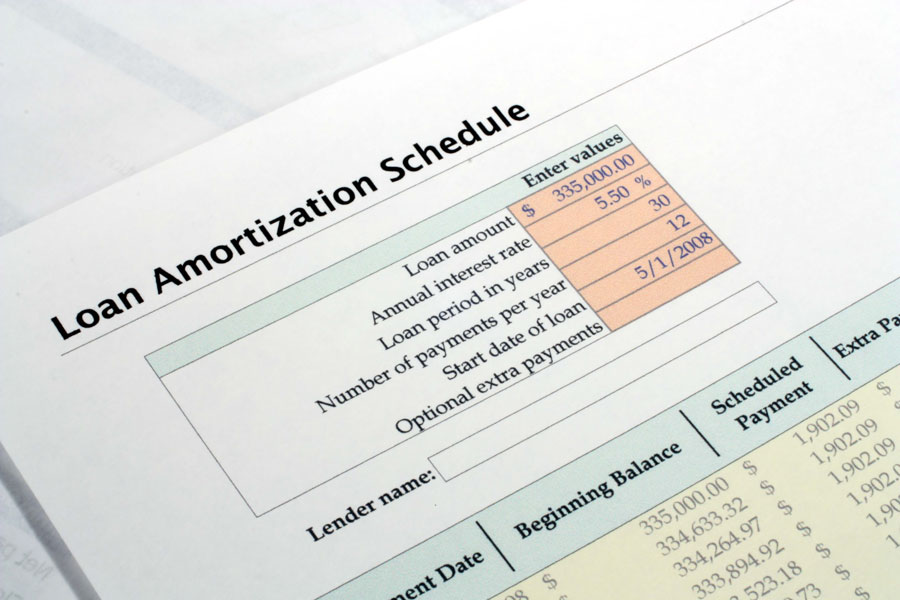

Cost Breakdown –

The document that breaks down all of the costs associated with the construction, including land, building materials and labor.

A lender can generally provide you with blank forms for the spec and cost breakdown if your builder does not have them.

Plot Plan –

Shows where your home will sit on the site, any accessory buildings, well and septic locations, if applicable, and the finish grade elevations and direction of the drainage.

Once the lender has obtained the above information from you, they will forward a copy to the appraiser. It is the appraiser’s job to determine what the future value of the home will be once it is completed, per your plans, specs & cost breakdown.

Even though an appraiser will use the cost approach in the appraisal report, it is not the value that will ultimately be used by the lender. The market approach to value, which uses existing sales of homes similar in size, quality, construction and location is the most common approach that lenders want for new construction.

The more complete and detailed your plans, specifications and cost breadown are, the more accurate your appraisal will be.

Once your home is complete, the appraiser will be asked to go out and inspect the home. They will report back to the lender what they have found, whether your home was completed according to the plans and specifications originally given, and if the value is the same as originally given in the report.

Sometimes the value has to be adjusted due to changes that were made during construction which may have affected the value of the home.

…..

Frequently Asked Questions:

Q: Where can I obtain a set of plans?

Most builders have basic plans they work from, and make modifications specific to their clients needs. When building a custom home, it’s generally a good idea to work with a reputable architect.

Q: Is there a form I can use for the list of specifications?

Yes, HUD has a generic form that most lenders use and it will give the appraiser most of the details they need to complete your appraiser. Anything not listed on this form can be added by you separately on an additional sheet.

Q: Can I use my contract with the builder for the cost breakdown sheet?

In most cases, the lender will accept the contract, however, they will want the builder to provide a cost breadown to ensure that the builder has accurately bid your home.

_________________________________

Related Appraisal Articles: